Our Banking Heritage

The origins of permanent tsb

Introduction

Permanent TSB can trace its origins back to the savings bank and building society movements of nineteenth-century Ireland. The name Permanent TSB reflects the heritage of both TSB Bank and Irish Permanent who joined forces in 2001 and in 2002 launched the Bank that we know today.

‘To assist, therefore, the industrious and frugal, to lay by such part of their earnings as they may be able to spare, SAVINGS BANKS have been formed in many places, and so great has been the encouragement they have received, that they are happily spreading in various parts of the kingdom.’

Anon., Some Account of the Establishment of the Savings Bank, School Street, Dublin: With the Rules and Regulations for its Management, 1818

Our

Savings Bank Origins

‘To assist, therefore, the industrious and frugal, to lay by such part of their earnings as they may be able to spare, SAVINGS BANKS have been formed in many places, and so great has been the encouragement they have received, that they are happily spreading in various parts of the kingdom.’

Anon., Some Account of the Establishment of the Savings Bank, School Street, Dublin: With the Rules and Regulations for its Management, 1818

Our Savings

Bank Origins

1816

Waterford Savings Bank

1817

Cork Savings Bank

1818

Dublin Savings Bank

1819

Monaghan Savings Bank

1820

Limerick Savings Bank

Permanent TSB’s earliest banking ancestors are five trustee savings banks established in Ireland between 1816 and 1820. The Waterford, Cork, Dublin, Monaghan, and Limerick Savings Banks all developed within the wider context of an evolving savings bank movement, the main aim of which was to promote thrift and to provide a place where ordinary people could deposit and save small amounts of money. The banks’ funds were lodged with the government who paid a generous interest rate, which was in turn passed on to depositors. Savings banks flourished in urban environments with high population densities – there were 74 in operation around the country in 1846 – but by the turn of the twentieth century all but these five had ceased operations.

‘This excellent institution [Waterford Savings Bank] opened for the first time on Monday at one o’clock at the Exchange and remained open until three, during which hours attendance will be given under the superintendence of the Secretary and at least two members of the Managing Committee every Monday for the purpose of receiving deposits of any amount not less than Tenpence.’

Waterford Mirror, 14 August 1816

© Image Reproduced Courtesy of the National Library of Ireland.

Waterford Savings Bank

Waterford Savings Bank has the distinction of having been established before the passing of the first Savings Bank Act in 1817 (picture above). The bank opened its doors on 7 August 1816 at the city’s Exchange on Quay Lane (now Exchange Street). A total of seventy-five passbooks were issued on the first day. By 1834 the Waterford Savings Bank held more than £75,000 on deposit. In 1846 the bank moved its headquarters to a purpose-built premises on O’Connell Street (pictured to the left). Waterford Savings Bank operated out of the O’Connell Street office until the mid-1990s when TSB Bank closed the branch and the building was sold.

© Image Reproduced Courtesy of the National Library of Ireland.

‘The [Cork Savings Bank] is thus, both in the personality of its staff and its clients, very intimately associated with the life of Cork City, and its eminent soundness and respectability are due in equal degrees to the wisdom and foresight of past citizens and to the capacity and attention to duty of those of the present.’

Anon., ‘Cork Savings Bank, 1817-1917’, Journal of the Cork Historical and Archaeological Society, 1917

Cork Savings Bank

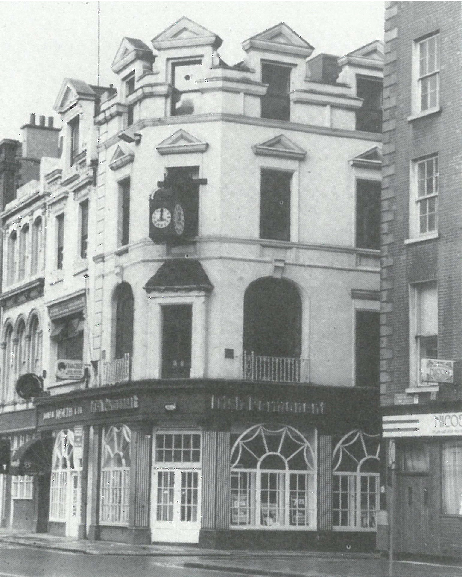

The Cork Savings Bank opened for business on Saturday, 20 December 1817, in a room at the Royal Cork Institution on South Mall in the centre of the city. The Catholic Bishop of Cork, John Murphy, and the Church of Ireland Bishop of Cork and Ross, Thomas St Lawrence, were two key figures behind the push to open a savings bank in Cork and it became a long-standing tradition for both bishops to serve on the board of the Cork Savings Bank (pictured to the left). During its first twelve months in operation the sum of £27,455 was received from 1,269 depositors. In 1839 the bank commissioned the design of a new premises on Lapp’s Quay (pictured above). The Lapp’s Quay branch of the Cork Savings Bank opened in 1842 and remained in operation for just over 170 years.

‘At a meeting of friends to the establishment of Savings Banks, called by public notice for the purpose of taking steps to set forward a Bank in this place for general benefit.’

From the first entry in the School Street Savings Bank minute book, 1818

© Image Reproduced Courtesy of the National Library of Ireland.

Dublin Savings Bank

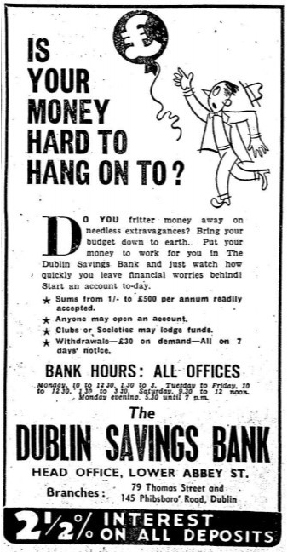

The Dublin Savings Bank started out as the School Street Savings Bank, so named because the bank’s trustees first convened in a schoolhouse on School Street in the Liberties area of the city. The bank was established on 11 February 1818 and was the second of its kind in Dublin. Among the earliest trustees of the bank were prominent local businessmen including members of the Guinness, Bewley and LaTouche families (whose names feature in the minute book above). Over the next few decades, the School Street Savings Bank expanded its operation across Dublin and eventually moved its head office and flagship branch to a new premises on Lower Abbey Street (pictured to the left). From 1844 onward, the bank was officially known as Dublin Savings Bank. At the beginning of 1845 deposits in the Dublin Savings Bank amounted to £435,336, representing the claims of 16,520 depositors.

‘[Monaghan Savings Bank] has done much to encourage thrift among the people of the town and district. Its integrity has become a tradition. The trustees are all gentlemen of substance, holding positions of responsibility and whose probity is above question.’

Northern Standard, 18 August 1922

Monaghan Savings Bank

Monaghan Savings Bank was founded on 26 April 1819. Though little is known of the bank’s earliest trustees, we do know that by November 1829 the bank had 490 depositors and funds of £12,798. In 1855 Monaghan Savings Bank moved its operations to a new building designed by William Deane Butler. Monaghan Savings Bank operated out of the ‘wee bank on the Hill’ (pictured to the left) until 1998 when a new TSB Bank branch opened on Dawson Street just 250 metres from the original savings bank.

© Image Reproduced Courtesy of Sean Curtis.

[Of the Limerick Savings Bank] 'Your savings bank is a friendly place where you are treated and looked on as a friend and any advice asked for is, if at all possible, freely given, and you are made to feel that the bank has interest in your personal welfare.’

From a paper read by Mr Alma Fitt, Secretary of the Bank, at a meeting of the Old Limerick Society in June 1949

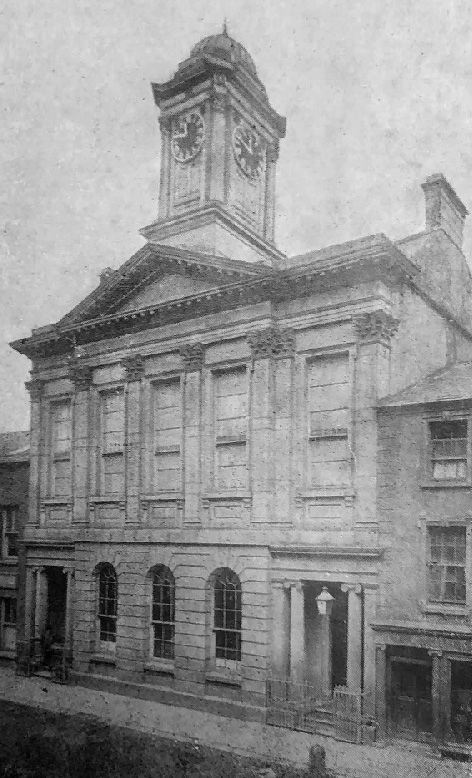

Limerick Savings Bank

The Limerick Savings Bank opened for business on 10 January 1820. At a meeting on 21 April 1820, the earliest meeting of which there is still record, the bank already had deposits of £1,671. Like many other savings banks, Limerick Savings Bank started its life in shared accommodation, in this case in the back room of a high-street shop. The bank then moved to the Labour Exchange in Upper Cecil Street. In 1839 the trustees and managers leased a site on Glentworth Street from the Earl of Limerick in order to construct a new bank headquarters. The stout columned building became affectionately known as the ‘Stone Jug’ (pictured above). The bank vacated the Glentworth Street building in 2006.

‘The Society’s policy for the future was, as in the past, to grant generous advances speedily on good house property to applicants of approved character. That was the corner-stone upon which the security of the Society had been and would be built.’

Address by Edmund Farrell, Managing Director and Secretary of Irish Permanent Building Society at the 63rd Annual General Meeting, 11 April 1947

Our Building

Society Origins

‘The Society’s policy for the future was, as in the past, to grant generous advances speedily on good house property to applicants of approved character. That was the corner-stone upon which the security of the Society had been and would be built.’

Address by Edmund Farrell, Managing Director and Secretary of Irish Permanent Building Society at the 63rd Annual General Meeting, 11 April 1947

Our Building

Society Origins

Permanent TSB’s building society origins stretch back to 1884 with the foundation of the Irish Temperance Benefit Building Society. Like savings banks, building societies in this era were set up with the motivation of helping people to help themselves. Members would come together to pool their funds and gradually raise enough money to provide low and no-interest loans for the purchase of property. The Irish Temperance Benefit Building Society eventually became known as Irish Permanent Building Society and by the 1960s it was the largest building society in Ireland.

© Image Reproduced Courtesy of the Historic Picture Archive.

Irish Temperance Benefit Building Society

On 1 May 1884 a meeting was held in the club rooms of the Dublin Coffee Palace and the Irish Temperance Permanent Benefit Building Society was established. Its purpose was to provide members with the means to purchase homes through the allocation of loans drawn from the funds held by the society. Though it was initially associated with the Temperance movement, the society changed its name to Irish Permanent Benefit Building Society in 1888 and by 1940 it was known simply as Irish Permanent Building Society. In the earliest days mortgages were allocated by lottery. On 13 October 1887, the earliest meeting of which we have record, a man named William Butler from Crumlin won the ballot and was granted a loan against his shares in the society.

The evolution of

TSB Bank

The evolution

of TSB Bank

1900-1950

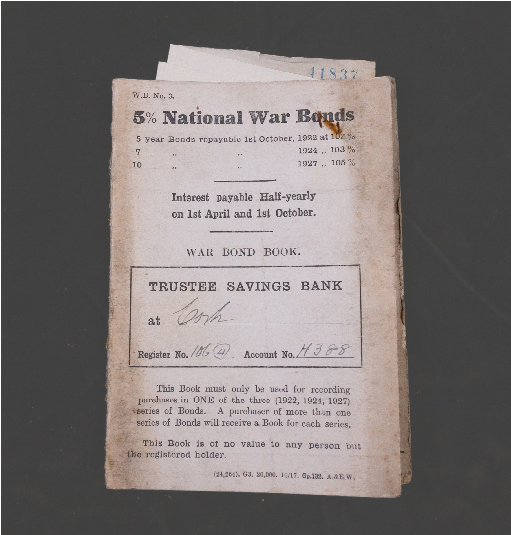

At the turn of the twentieth century, the five remaining Irish savings banks had a loyal, increasingly middle-class customer base. From the outbreak of the First World War in August 1914 trustee savings banks and post office savings banks played an important role in encouraging depositors to subscribe to war loans and war saving certificates (pictured to the left). Up to September 1917, the post office and trustee savings banks collected a total of £220 million in war stocks. Following the war, working-class prosperity and the removal of limits on savings bank deposits contributed to a steady increase in depositors and funds. Following the creation of the Irish Free State in 1922 legislation had to be introduced so that trustee savings banks in Ireland could begin to lodge their funds with the Irish government.

The advent of the World War II, or the ‘Emergency’ as it was known in Ireland, created a society that was even more thrift and saving-conscious. The year 1945 was declared a record year for savings, with deposits in Irish savings banks exceeding £10 million for the first time. Throughout the second half of the twentieth century the trustee savings banks would expand their networks and services while fulfilling their longstanding aim of improving facilities for thrift and saving.

1950-2001

The 1950s and 1960s were decades of steady growth for savings banks in Ireland. Total funds across the banks increased to £40 million in 1970. By this time, Dublin Savings Bank had a network of seven branches, while Cork Savings Bank had opened two additional branches in Cathedral Road (opened in 1957) and Princes Street (opened in 1966). In 1969 the banks launched investment account departments, offering higher rates of interest for longer-term investors, and personal loan facilities. The launch of current accounts in 1971 marked another step towards the provision of a full family banking service. Despite the increase in business and the expansion of their financial services, trustee savings banks were frustrated by the limitations on their lending and investment powers. They were still obliged to invest any surplus funds with the Minister for Finance on which they received only a 1 per cent margin.

In 1976 the first savings bank merger took place and Monaghan Savings Bank became part of the Dublin Savings Bank group. In 1980 the remaining Irish trustee savings banks launched a major joint branding and advertising campaign to raise their national profile and to emphasise the consistent services provided across all savings banks. From 1980 onwards Dublin Savings Bank begins to trade under the name Trustee Savings Bank (or TSB) Dublin. In November 1986 Cork Savings Bank and Limerick Trustee Savings Bank merged and became the Cork and Limerick Savings Bank. The merger of Waterford Savings Bank and Trustee Savings Bank Dublin was announced in January 1988.

The 1989 Trustee Savings Bank Act was the most significant piece of legislation relating to savings banks to be introduced in Ireland in over a hundred years. It effectively repealed all previous savings bank legislation and enabled the TSBs to provide a banking service in equal competition with other financial institutions.

Cork and Limerick Savings Bank amalgamated with TSB Dublin in 1992 and launched TSB Bank, which, at the point of its creation, had combined assets of over £1 billion and a network of 69 branches nationwide. Towards the end of the 1990s, the state began to put pressure TSB Bank to find a new owner or strategic partner with which to privatise its business.

The evolution of Irish Permanent

The evolution of

Irish Permanent

1900-1960

Between 1900 and 1930 the Irish Permanent Benefit Building Society continued to attract new members and grow steadily. In the 1940s the society underwent a number of significant changes. The rules were altered so that loans were no longer allocated by ballot and instead the society began to charge interest on advances. It also began attracting investing members for the first time. Other changes in the 1940s included the appointment of a number of full-time staff, the creation of building society agencies in major cities and towns outside Dublin and the roll-out of an extensive newspaper advertisement campaign in regional newspapers across Ireland. In March 1948 the rapidly growing building society moved to new premises at 54 Dame Street. By this stage it also had agents working out of representative offices in Cork, Limerick, Galway, Wexford and Tralee.

In 1953 Irish Permanent Building Society acquired the premises at 13 O’Connell Street and moved its head office to Dublin’s main thoroughfare. The distinctive façade of the building was soon incorporated into the new Irish Permanent logo and variations on this design formed the basis of the company logo for the rest of the century.

1960-2001

By 1963 the Irish Permanent had become Ireland’s largest building society with total assets of £9 million. In 1967 the Society’s first full branch office was opened in Patrick Street, Cork, and from then on the acquisition of prime location offices became a major means of servicing members’ requirements and of consolidating the society’s top position in the Irish finance market. In the 1970s Irish Permanent acquired three building societies: Provident Building Society in 1974, Cork Mutual Benefit Building Society in 1975, and Munster and Leinster Building Society in 1975. These consolidations marked the end of an era for smaller building societies in Ireland.

By the end of the 1980s Irish Permanent Building Society had more than two hundred branches across all twenty-six counties. A major piece of legislation, the Building Societies Act, 1989, came into force in September of that year. The underlying objective of the Act was to provide a framework for the deregulation of building societies so that they could compete effectively in the wider financial services marketplace.

In December 1989 Irish Permanent Building Society voted to adopt the new powers provided for in the Building Societies Act. By the end of 1991 Irish Permanent had successfully branched out into commercial mortgages, pensions, life assurance and property investment, and launched a variety of new consumer finance products including a current and ATM accounts service and their first unsecured lending product. In 1992 Irish Permanent opened branches in London and Belfast as well as a subsidiary in the Isle of Man.

March 1994 saw the members of the Irish Permanent Building Society vote to de-mutualise and convert the society to a public limited company. Each qualifying member received a bonus of 300 free shares and the option to purchase a further 300 at 180p per share. On 27 October 1994 Irish Permanent plc became the first Irish building society to be publicly traded on the London and Irish stock exchange.

In 1999 Irish Permanent merged with Irish Life, the largest insurance provider in Ireland. The company was renamed Irish Life & Permanent and Irish Permanent continued to operate under its own brand as the banking arm of the group.

The creation of Permanent TSB

The creation of

Permanent TSB

2000-2002

In December 2000 it was announced that Irish Life & Permanent would acquire TSB Bank from the Irish government for €430 million and that the bank created from the merger would be known as Permanent TSB. Since its creation in 1999, the Irish Life & Permanent Group had identified business in Ireland as its main area of focus and the decision to amalgamate TSB Bank with Irish Permanent was evidence of this ‘Ireland First’ strategy in action. Like Irish Permanent before it, the new bank would sit under the larger Irish Life & Permanent parent company as its retail banking arm.

In April 2001, the purchase of TSB Bank by Irish Life & Permanent was formally ratified by the then Minister for Finance, Charlie McCreevy. Permanent TSB was formally launched to the market in February 2002. At the time of its creation, the Permanent TSB had 1.2 million customers and held between eight and ten per cent of Irish current account business and approximately 25 per cent of the Irish mortgage market. From the outset the vision for the new retail bank was to bring enhanced services to its customers and new competition to the Irish banking industry.

The amalgamation of Irish Permanent and TSB Bank in 2001 signified a convergence of the historical trustee savings bank and building society movements in Ireland, both of which arose from a desire to put financial power in the hands of Ireland’s middle and working classes.

Our recent history

Our recent history

2009-2012

Turbulent times in Ireland’s financial services sector resulted in the Irish State being required to capitalise on all Irish banks. In 2011 Irish Life & Permanent became 99.2% state owned and in 2012 Permanent TSB separated from the Irish Life & Permanent Group and became a wholly owned subsidiary of Permanent TSB Group Holdings plc. Under new CEO, Jeremy Masding, formal restructuring plans for the Bank were approved by the European Commission in July 2012. The plans were designed to create a smaller profitable new Permanent TSB and secure the future of the company as an efficient, competitive and customer-focused bank.

2015-2020

The year 2015 marked a major turning point for Permanent TSB as the Bank returned to profitability for the first time since 2007. In 2019 Permanent TSB joined with the four other retail banks operating in Ireland to launch the Irish Banking Culture Board whose purpose is to help rebuild public trust in Irish financial institutions. The following year the Bank launched its own new purpose: 'To work hard every day to build trust with our customers - we are a community serving a community,' as well as a new ambition to be Ireland’s best personal and small business bank.

2021-2022

In December 2021 Permanent TSB signed a binding agreement to acquire €7.6 billion of retail and SME assets from Ulster Bank, including the Lombard Asset Finance business. Permanent TSB is now firmly focused on delivering sustainable commercial and profitable growth as we continue to grow our share in the Irish market.

Our Banking Heritage

The history of Permanent TSB is also documented in a book produced by the Bank to mark the twentieth anniversary of the launch of Permanent TSB. If you would like to dive a bit deeper into the history of Permanent TSB you can download a PDF of Our Banking Heritage: The Origins of Permanent TSB here.